|

|

The U.S. Department of Education has announced the Office of Federal Student Aid (FSA) will resume collections of federal student loans that are in default on May 5.

“The Department has not collected on defaulted loans since March 2020,” says a press release. During the pandemic, the federal government paused collections and defaults on student loans.

The intent, says the press release, is to “move the federal student loan portfolio back into repayment.”

The press release makes clear “the message,” which it says is that “student and parent borrowers — not taxpayers — must repay their student loans. There will not be any mass loan forgiveness.”

A comprehensive communications campaign to borrowers is planned.

Secretary of the U.S. Department of Education Linda McMahon followed up the press release with this op-ed in the Wall Street Journal, which the department sent to EdNC via email:

In the op-ed, McMahon says, “Why? Not because we want to be unkind to student borrowers. Borrowing money and failing to pay it back isn’t a victimless offense. Debt doesn’t go away; it gets transferred to others. If borrowers don’t pay their debts to the government, taxpayers do.”

The policy considerations behind student loans

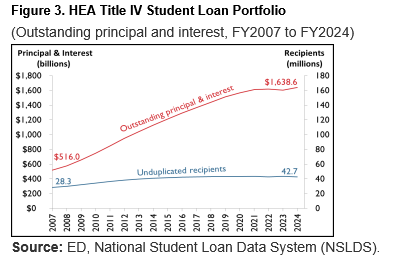

According to federal data, 42.7 million students had loans at the end of 2024, totaling $1.6 trillion. Of those, 1.37 million live in North Carolina, totaling $53.3 billion.

As the Trump-McMahon administration moves forward with plans to dismantle the U.S. Department of Education, it is anticipated that the student loan portfolio will be moved to the Small Business Association.

In February, the Congressional Research Service published a report, titled “A Snapshot of Federal Student Loan Debt.” According to the report, “Title IV of the Higher Education Act of 1965 (HEA) authorizes the primary federal student loan programs.”

In this graphic from the report, you can see how loans have increased since 2007.

The report identifies the following debt policy issues:

Loan limits and availability | To what extent should annual and aggregate limits cap the amount of student loan debt incurred by individuals? Should students and their families be able to use federal student loans to finance any amounts that they are expected to contribute from their own income or assets toward college expenses, based on federal student aid rules?

Loan repayment terms and conditions | Should the current mix of repayment plans be altered or streamlined? If so, how should various repayment plan alternatives balance competing aims such as keeping monthly payments affordable, facilitating the payment of principal and interest, and limiting costs to the government? To what extent should repayment plan options account for differences between undergraduate and graduate students or differences in borrowers’ economic circumstances?

Loan forgiveness and cancellation | How should the potential advantages of granting debt relief be weighed against concerns about its cost to the government? How does the prospect of relief from the obligation to repay some portion of their debts influence students’ higher education and career choices and the amount of debt they are willing to incur?

Debt and societal wellbeing | How do the benefits of an education financed with federal student loans and the burden of loan repayment interact and affect borrowers’ opportunities, well-being, and choices concerning careers, family formation, home ownership, savings, and wealth accumulation? How should the responsibility for funding or financing the costs of a college education be distributed among the individual, the higher education sector, and different levels of government?

Sustainability of the federal loan portfolio | The federal student loan portfolio continues to grow as new loans are disbursed at a faster rate than existing loans are repaid. What are the long-term implications of the federal government overseeing and administering a growing and increasingly complex loan portfolio? How does federal administration of student loan programs and the use of nonfederal loan servicers impact borrowers’ ability to realize existing benefits and other forms of relief?

The Biden-Cardona approach

A press release issued on Jan. 16, 2025 — one of the last to be issued before the transition between administrations — documents the Biden-Cardona approach to student loans.

“Four years ago, President Biden made a promise to fix a broken student loan system. We rolled up our sleeves and, together, we fixed existing programs that had failed to deliver the relief they promised, took bold action on behalf of borrowers who had been cheated by their institutions, and brought financial breathing room to hardworking Americans — including public servants and borrowers with disabilities. Thanks to our relentless, unapologetic efforts, millions of Americans are approved for student loan forgiveness,” said then-U.S. Secretary of Education Miguel Cardona. “I’m incredibly proud of the Biden-Harris Administration’s historic achievements in making the life-changing potential of higher education more affordable and accessible for more people.”

The press release says, “The Administration leaves office having approved a cumulative $188.8 billion in forgiveness for 5.3 million borrowers across 33 executive actions.”

It outlines the following accomplishments:

Fixed longstanding problems with Income-Driven Repayment (IDR). The Administration has approved 1.45 million borrowers for $57.1 billion in loan relief, including$600 million for 4,550 borrowers announced today for IBR forgiveness.

Restored the promise of Public Service Loan Forgiveness (PSLF). The Administration has approved 1,069,000 borrowers for $78.5 billion in forgiveness.

Automated discharges and simplified eligibility criteria for borrowers with a total and permanent disability. The Administration has approved 633,000 borrowers for $18.7 billion in loan relief.

The press release also provided this state-by-state breakdown of student debt relief under the Biden-Cardona administration. According to the data, 147,990 borrowers in North Carolina benefited from the relief.

The Trump-McMahon approach

“The Biden Administration misled borrowers,” says McMahon in the press release, “the executive branch does not have the constitutional authority to wipe debt away, nor do the loan balances simply disappear.”

Resuming collections protects taxpayers from shouldering the cost of federal student loans that borrowers willingly undertook to finance their postsecondary education. This initiative will be paired with a comprehensive communications and outreach campaign to ensure borrowers understand how to return to repayment or get out of default.

U.S. Department of Education press release

“American taxpayers will no longer be forced to serve as collateral for irresponsible student loan policies,” says McMahon. “Going forward, the Department of Education, in conjunction with the Department of Treasury, will shepherd the student loan program responsibly and according to the law, which means helping borrowers return to repayment — both for the sake of their own financial health and our nation’s economic outlook.”

According to the press release,

More than 5 million borrowers have not made a monthly payment in over 360 days and sit in default—many for more than 7 years—and 4 million borrowers are in late-stage delinquency (91-180 days). As a result, there could be almost 10 million borrowers in default in a few months. When this happens, almost 25 percent of the federal student loan portfolio will be in default.

Only 38 percent of borrowers are in repayment and current on their student loans. Most of the remaining borrowers are either delinquent on their payments, in an interest-free forbearance, or in an interest-free deferment. A small percentage of borrowers are in a 6-month grace period or in-school.

Currently, almost 1.9 million borrowers have been unable to even begin repayment because of a processing pause put in place by the previous administration. Since August 2024, the Department has not processed applications for enrollment in any repayment plan such as Income-Based Repayment, Income-Contingent Repayment, or PAYE. The Department is currently working with its federal student loan servicers and anticipates processing to begin next month.

What happens next?

According to the press release,

FSA will restart the Treasury Offset Program, administered by the U.S. Department of Treasury, on Monday, May 5, 2025.

All borrowers in default will receive email communications from FSA over the next 2 weeks making them aware of these developments and urging them to contact the Default Resolution Group to make a monthly payment, enroll in an income-driven repayment plan, or sign up for loan rehabilitation.

Later this summer, FSA will send required notices beginning administrative wage garnishment.

The Department will also authorize guaranty agencies that they may begin involuntary collections activities on loans under the Federal Family Education Loan Program.

“All FSA collection activities are required under the Higher Education Act and conducted only after student and parent borrowers have been provided sufficient notice and opportunity to repay their loans under the law,” says the press release.

Resources for borrowers

Start here at the Federal Student Aid website. Note the different drop down menus on loan repayment and loan forgiveness.

Under loan repayment, here is information about student loan delinquency and default.

You can find out what kind of loan you have and get more information about your loan through the National Student Loan Data System.

If you are already in default, here is more information.

When you are ready to pursue your options and have the information about your loan at hand, here is the debt resolution website.