|

|

How much money does the legislature have to invest in western North Carolina? How much money does it have to increase pay for educators?

Last week, economists from the Office of State Budget and Management (OSBM) and the Fiscal Research Division (FRD) released what’s called “the consensus revenue forecast.”

Additional context can be found in the 2024 Annual Comprehensive Financial Report from the Office of the State Controller, released on Dec. 19, 2024.

As the long session of the General Assembly gets underway, the forecast helps us understand how much money the legislature will have to budget in the 2025-26 and 2026-27 fiscal years. The availability of revenue is driven in part by economic factors — for example, inflation — and in part by policy choices — for example, tax cuts.

Here is the upshot: There is $544 million in unanticipated revenue this year, but it gets tighter next year, and then there could be a deficit the year after that. The state has spent down its rainy day fund to the suggested amount, but there is $1 billion in another fund that policymakers could used to address the needs of the state.

How much money does the state spend currently?

In 2024-25, the legislature approved state appropriations of $31.64 billion.

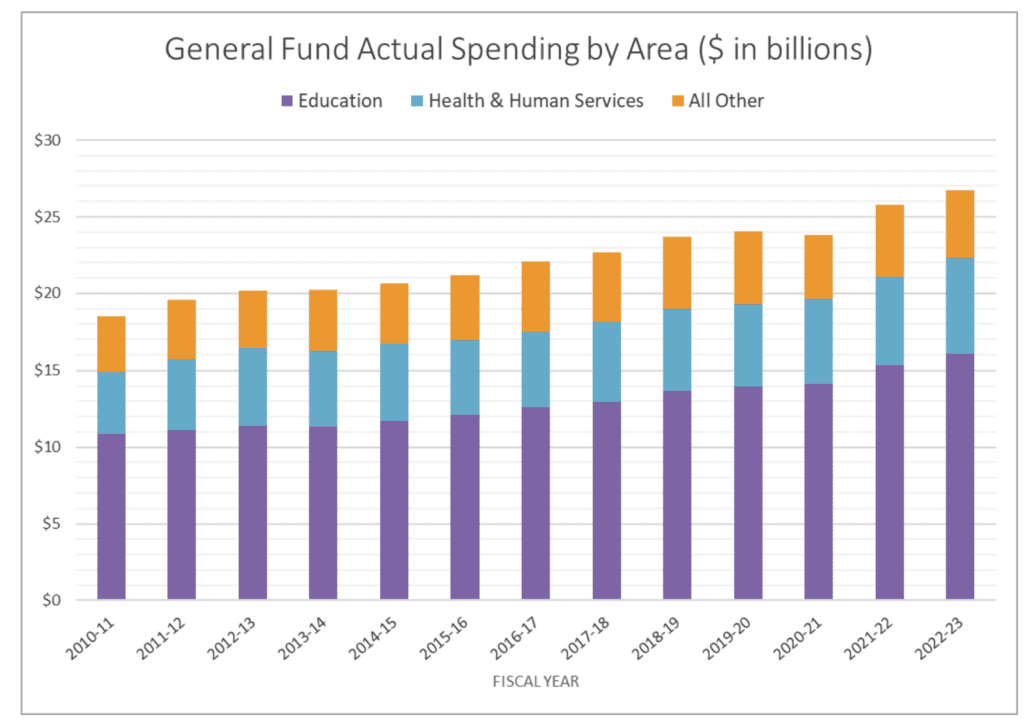

Here you can get a sense of how spending has increased year-over-year since 2010, according to FRD:

Note that how much money is appropriated by the legislature is different than how much money actually ends up being spent.

Education spending — which includes K-12, the community colleges, and the UNC System — always makes up the biggest share of the state budget.

The outlook

Revenue exceeded the forecast for 2024-25, is expected to be flat for 2025-26, and then a decline is anticipated in 2026-27.

The consensus revenue forecast anticipates collections of $34.71 billion in FY 2024-25, representing overcollections of $544 million (+1.6%). That’s good.

“The upward revision is due to more robust economic growth and financial conditions than foreseen at the time of the last consensus forecast in May 2024,” it says.

The consensus revenue forecast anticipates collections of $34.89 billion in FY 2025-26 with year-over-year growth of 0.5%, and $34.07 billion in FY 2026-27 with year-over-year growth of -2.4%.

The forecast thus anticipates that state revenues will be lower by $641 million in two years. That’s worrisome.

“Economic factors exerting upward pressure on the forecast are outweighed by downward pressure from reductions in the individual and corporate income tax rates, resulting in negligible growth in FY 2025-26 and a decline in FY 2026-27,” it says.

According to the forecast, individual income tax rates declined from 4.5% in 2024 to 4.25% in 2025 and will decline to 3.99% in 2026 and 3.49% in 2027 because of cuts to taxes by the legislature.

The corporate income tax rate declined from 2.5% in 2024 to 2.25% in 2025 and will decline to 2% in 2026, says the forecast.

The question is how much spending will need to increase relative to inflation and other economic factors in addition to addressing the needs of the state, which includes year-to-year governmental spending, money for policy changes enacted by the legislature, Hurricane Helene, possible changes to how federal funding flows into the state, plus the need to have a rainy day fund for other natural disasters as well as a fund for economic fluctuations among other things like capital investments. Advocates would argue that historic under-investments in key governmental services should be added to that list.

“While today’s consensus revenue forecast for this year is positive,” says a press release from Gov. Josh Stein, “North Carolina is approaching a fiscal cliff that threatens our ability to invest in rebuilding western North Carolina, strong public schools, people’s health, infrastructure, and other services we need to make North Carolina safer and stronger.”

“I am committed to working with the legislature to develop solutions that allow us to continue to invest in our state’s future,” Stein says, looking to both the state’s growing economy and population growth.

What about the lottery?

The consensus lottery forecast revises revenue projections for FY 2024-25 up 9.3% from $1.01 to $1.10 billion, “primarily because of higher-than-expected growth in digital instant sales.” That’s a big increase.

The consensus forecast for the lottery is $1.12 billion in FY 2025-26 and $1.13 billion in FY 2026-27, representing year-over-year growth of 2.0% and 0.6%, respectively.

What about the rainy day fund?

To date, according to the Office of the Controller, the legislature has approved the following transfers from the state’s Savings Reserve — often called the rainy day fund — to the Hurricane Helene Disaster Recovery Fund:

- On Oct. 10, 2024, Session Law 2024-51 approved the transfer of $273 million from the Savings Reserve to the Helene Fund to provide state matching funds for federal disaster assistance.

- On Oct. 25, 2024, Session Law 2024-53 approved an additional $604.15 million to support recovery efforts, including funding for education, health, agriculture, public safety, and other critical areas.

- On Dec. 11, 2024, Session Law 2024-57 approved another $227 million to provide additional funding for the necessary relief and assistance from the effects of Hurricane Helene.

On Jan. 28, 2025, OSBM and FRD released this memo, which says they agree that the state’s Savings Reserve should maintain a balance of 11.9% of prior-year General Fund operating budget appropriations — and 11.9% of $31.64 billion is $3.77 billion.

In January 2025, the Savings Reserve had $3.73 billion.

It is unlikely the legislature will spend down the rainy day fund much below the suggested amount.

What is the Stabilization and Inflation Reserve Fund?

In his proposed budget for the next round of Hurricane Helene funding, Stein suggested using $846,729,750 from the Stabilization and Inflation Reserve Fund in addition to $225,000,000 from the Hurricane Helene Disaster Recovery Fund.

According to the Office of the Controller, “The 2021 General Assembly established the Stabilization and Inflation Reserve in the General Fund. The purpose of the reserve is to make, only upon an act of appropriation by the General Assembly, funds available to be used for costs associated with inflation and other measures necessary to stabilize the State economy.”

What happens next?

The governor, the Senate, and the House will all use the consensus revenue forecast to prepare their respective budget proposals.

Some advocates are already calling on the legislature to pause corporate tax cuts and those on wealthy individuals.