|

|

That the American health care coverage system is broken shouldn’t come as a shock to anyone, even proponents of the 2010 Affordable Care Act who thought Obamacare would make coverage affordable for everyone. But as long as workers with employer-subsidized health care are forced to rely on the generosity of capitalists for their health and well-being, there will continue to be crises like the one currently unfolding with soon-to-be unemployed workers at Pactiv Evergreen’s Haywood County facilities.

As with nearly every other aspect of the mill’s forthcoming closure, Pactiv has been anything but proactive and communicative, especially in educating its workers about their impending loss of health care coverage.

Now, on short notice and with few specifics, Haywood County’s nonprofit, government, and educational community, along with state agencies, have to band together to clean up a mess Pactiv could have averted months ago, while workers are forced to make major decisions that could have a substantial impact on both their health and their household budgets.

“Once again, without warning, we are dealing with another crisis,” said Zeb Smathers, Canton’s mayor. “In the same breath, Canton, Haywood County, and our partners across the state are going to do all that we can in next few months to make sure workers and their families receive the medical necessities they’re entitled to.”

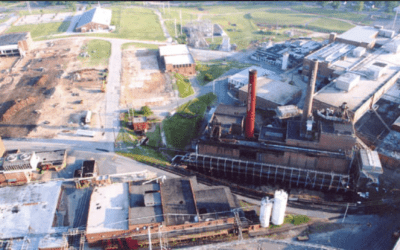

Workers at Pactiv Evergreen’s century-old paper mill in Canton were informed on March 6 that in roughly three months, most of them would no longer have the jobs their families had come to depend on not only for good wages and retirement benefits, but also for health care coverage.

While another Pactiv facility in Waynesville will stay open for the foreseeable future — contrary to inaccurate reports in the Mountaineer — company officials said it will see substantial job cuts, which will leave many workers there in the same situation as those in Canton.

For most Pactiv employees in Haywood County, their final day at work will be June 9, but current insurance coverage by Blue Cross Blue Shield of Illinois will continue as normal through June 30.

On July 1, employees will be switched over to an employer-sponsored COBRA plan.

Passed in 1985, the Consolidated Omnibus Reconciliation Act (COBRA) grants to workers the right to continue the group health care coverage provided by their employer even after voluntary or involuntary separation from their employer. Employer-sponsored COBRA costs roughly the same as when the worker was employed because the employer, in this case Pactiv, will still make contributions toward the plan’s cost.

Sometimes, employer-sponsored COBRA can last many months, which helps recently unemployed workers maintain affordable coverage in the wake of losing their paychecks.

Pactiv’s employer-sponsored COBRA will last exactly one month.

On Aug. 1, employer-sponsored COBRA will end, leaving workers with some important decisions about their health care coverage. Those decisions need to be made well in advance of Aug. 1 to ensure continuity of coverage.

Some employees may have the opportunity to hop onto a spouse’s plan — possibly the cheapest option. Those without such a backup option could decide to purchase their own health care coverage.

The Affordable Care Act, often called Obamacare, offers subsidies for people who qualify. Due to the relatively good wages earned by most workers at Pactiv’s Haywood facilities, many likely won’t, but advanced premium tax credits could help some.

An individual making more than $54,360 would not likely qualify for a subsidy, nor would a family of four making more than $111,000, although the estimated 2023 income of laid-off workers can be considered in some cases. A 2022 report to the North Carolina Department of Commerce filed by Pactiv lists the average wage at the Canton mill as $84,199.

Medicare and Medicaid may be an option for some, but income and age restrictions mean they’re not for everyone.

The final option is to remain on COBRA, but after the month of employer-sponsored COBRA ends, former employees will be responsible for 100% of the cost of COBRA, because Pactiv no longer has to make contributions to the cost of the plan.

COBRA can last anywhere from 18 to 36 months after separation, depending on specific circumstances unique to each employee, but in any event, it’s not cheap.

And there’s a catch — if an employee has already met their yearly deductible with Blue Cross Blue Shield, COBRA is the only plan that would recognize that out-of-pocket spending. For every other option, the insured person would have to again pay out of pocket until meeting their new deductible.

That sets up a dizzying array of scenarios, none of which are particularly appealing for the soon-to-be uninsured. If an employee has met their annual deductible and has a major procedure scheduled for later in the year, the smart move would probably be to stick with COBRA. But for recently unemployed workers, the cost of COBRA coverage may be unaffordable, leaving only the option to purchase a less expensive plan where deductible spending resets to zero — meaning that major procedure would have to be rescheduled, or paid 100% by the patient.

Employees can apply for COBRA coverage beginning June 2. Those who have already left work at Pactiv can still enroll up to 60 days after termination of coverage, but those who wait until after employer-sponsored COBRA ends on July 31 will experience a coverage gap for the month of August.

Once an employee declines COBRA coverage, there’s no going back.

To help workers navigate the situation, Blue Cross Blue Shield of North Carolina will host two events at Haywood Community College (HCC) from 9 a.m. to 6 p.m. on May 23 and 24. The events are appointment-only, but walk-ins may be considered if space allows.

“Blue Cross NC has partnered with Haywood Community College, the county DHHS office, and the local ACA navigator group to provide education and support around employees’ insurance and health care options,” said Mebane Rash, who has been researching and reporting on the mill closure for EdNC. “The purpose of these meetings is to review all possible options available to each individual or family and help them determine what makes the most sense for them (COBRA compared to ACA or joining a spouse’s plan). Also, Blue Cross NC will have Medicare information available at all sessions.”

As with most crises in Haywood County involving basic human needs, local social services agency Mountain Projects is a key player in the effort.

“This is really something we can truly help them navigate through, because medical debt is one of the quickest accruing and one of the most damaging things to your credit,” said Jan Plummer, a program coordinator at Mountain Projects. “Just getting a broken leg can cost up to $10,000.”

If workers don’t line up some sort of coverage, the county’s sole hospital, Haywood Regional Medical Center, could see catastrophic consequences from providing uncompensated care to those who become sick or injured — underscoring the importance of the navigator sessions at HCC.

“Even though they may be overwhelmed with working their hours at the mill, the employee can send somebody from the household, or their spouse, to represent them,” Plummer said.

Plummer said future navigator sessions may be scheduled as demand dictates, and that Mountain Projects will remain available to help answer questions related to medical coverage, food assistance, or other issues brought about by the closing of the mill.

It didn’t have to be this way, but given Pactiv’s actions leading up to the closing announcement, it should come as no surprise that many employees are only just now finding out that they’ll soon lose health care coverage without taking immediate action.

When the closing was first announced by Pactiv on March 6, many workers found out through social media, rather than from their employer. Mayor Smathers was given no advance notice, nor was James Graven, mayor of an Ohio town where Pactiv will close another facility. Graven said he found out the day after Pactiv’s announcement, on social media.

On March 21, Canton mill manager John McCarthy sent a letter to employees, advising them of company-sponsored opportunities to learn more about what would happen to them in the coming days.

The three-page letter includes notice of open office hours at the company’s human resources department, an employee assistance program, orientation events, a career fair, and financial planning sessions to discuss retirement and 401(k) implications of the closing.

The only mention of health care coverage comes at the top of page three — with a phone number and website address for Blue Cross Blue Shield of Illinois, but without any mention of the urgency that now underlies this impending health care coverage crisis.

“Not only has the timeline of closing been extremely stressful and challenging, now we realize that miscommunications have impacted workers and their families, including their children, and their potential to receive timely and necessary medical care,” Smathers said. “These workers deserve better than to have another layer of stress added to them as many look for jobs.”

Multiple officials speaking on the condition of anonymity have told The Smoky Mountain News that Pactiv Evergreen’s failure to communicate with Blue Cross Blue Shield of Illinois about their impending shutdown back in March prevented Blue Cross Blue Shield of Illinois from entering the mill to speak directly with workers.

Neither Pactiv nor Blue Cross Blue Shield of Illinois returned calls from The Smoky Mountain News to answer questions about who knew what, and when.

Blue Cross Blue Shield of Illinois could delegate its responsibility to Blue Cross Blue Shield of North Carolina, but so far, that hasn’t happened.

Fortunately, Haywood County knows how to come together during times of tragedy. In August 2021, flooding associated with the remnants of Tropical Storm Fred killed six people and decimated parts of the county, including Canton.

The relief efforts from churches, government agencies, nonprofits, private businesses, and ordinary individuals showcased the grit and the grace this hardscrabble region is historically known for when times get tough.

In dealing with this latest tragedy, Haywood’s rapid response partners have something they didn’t really have during the floods — a playbook.

Back in July, 2003, Kannapolis-based Pillowtex Corp filed bankruptcy, laying off 7,650 workers at 16 North American facilities, 4,800 of whom were based in North Carolina. At the time, it was the largest mass layoff in the history of the state.

After it all went down, a report authored by Myra Beatty, Douglas Longman, and Van Tran titled “Community Response to the Pillowtex Textile Kannapolis Closing: The ‘Rapid Response’ Team as a Facilitative Device” provided important documentation of how the surrounding community reacted, what worked, and what didn’t work.

In contrast to Pactiv, Pillowtex was known to be in financial trouble well in advance of the bankruptcy and took proactive steps months before the closing was announced, meeting with federal and state officials to begin addressing the implications of the layoffs. Because federal and state officials knew the layoffs were coming, they had the luxury of anticipating the needs and discussing solutions.

Pactiv never notified Gov. Roy Cooper of its intentions to close the Canton mill, and representatives from the North Carolina Department of Commerce told The Smoky Mountain News on March 9 that the agency was already working to roll out resources for Pactiv employees, despite also having received no notice from Pactiv.

In the case of Pillowtex, that lead-up time allowed local DSS agencies along with the United Way, Carolina Christian Ministries, the local workforce development board, and various municipal governments to conduct a needs assessment and establish a centralized community service center, where affected workers could access a variety of services predicted by the needs assessment.

That hasn’t yet happened in Haywood County, largely due to Pactiv’s reluctance to communicate with anyone, about anything.

Predictably, one of the main concerns shared by Pillowtex employees was the fate of their health care coverage.

As with Pactiv’s workers, Pillowtex employees had about two months to figure out their health care coverage options after the company terminated its self-insured, Blue Cross Blue Shield-administered health care coverage plan.

For Pillowtex employees, a confusing assortment of federal programs were available to provide subsidies for health care coverage, but each was imperfect in its own way.

The Trade Adjustment Assistance (TAA) Reform Act of 2002 was already in place to provide benefits to workers negatively impacted by trade policy.

Those benefits included job training, job search assistance, and GED and ESL classes — between 40 and 50% of Pillowtex employees did not have a high school diploma, and approximately 500 did not speak English, according to the needs assessment — as well as up to 104 weeks of income assistance and a Health Coverage Tax Credit (HCTC) that would subsidize 65% of health insurance premiums.

However, the HCTC was provided as a tax credit, with little immediate benefit to unemployed workers who couldn’t afford to pay huge upfront premiums in the first place.

Although that tax credit was later modified so that it could be applied at the time of payment rather than after the fact, the state didn’t even have a qualified administrator for the HCTC program at that moment.

By the time Blue Cross Blue Shield stepped up with a proposal to administer the HCTC, at least two months had passed.

There was also known issue with the timeliness of TAA payments.

The State of North Carolina received a requested National Emergency Grant from the U.S. Department of Labor on Aug. 15, 2003, totaling nearly $21 million. Of that, $13 million was for employment-related services, including $2.5 million to community colleges, and $7.6 million was to act as a “bridge” to pay for the 65% health care subsidies while TAA payments were still pending.

“For practical purposes, workers had no health insurance coverage between the time Pillowtex terminated its plan July 30th and the time that the (Blue Cross Blue Shield) plan with (National Emergency Grant) payments became available in October,” reads the Pillowtex report.

Even after all that waiting and wrangling and hand-wringing, the final product rolled out to unemployed workers resulted in substantial sticker shock.

“The net result was that even with a 65% subsidy, the cost of coverage was simply unaffordable,” says the report.

Given the pre-Obamacare provenance of these federal programs, it’s not clear if they still exist in that form, or if other federal programs are available to help the workers Pactiv wouldn’t, but Western North Carolina’s congressman isn’t talking. Rep. Chuck Edwards (R-Henderson) has ignored multiple opportunities to speak with The Smoky Mountain News (SMN) about what, if anything, he’s done in regard to Pactiv, dating back to when he was first informed of troubles at the mill by SMN more than a month before the closing was announced.

It’s conceivable that health-related nonprofit grants or foundational support could be utilized to help workers with premiums, but this late in the game, organizations would have to hustle to ensure workers don’t find themselves in a coverage gap. There may be a role for state government as well, but a variety of factors make that a complicated practical and philosophical issue.

“At the last council of state meeting with the governor, he did talk about this situation, and he urged every agency to do what we can to help the people of Canton, particularly those employees that are losing their jobs,” said Mike Causey, North Carolina’s Commissioner of Insurance.

Causey said that to his knowledge, his office hadn’t heard any concerns from Blue Cross Blue Shield of Illinois, but that he would reach out to Illinois’ insurance department to ensure they’re aware of the situation and that he’d also contact state and national Blue Cross Blue Shield offices to see if there’s anything else he could do.

“We’re planning to open a regional office for the Department of Insurance in Canton, to do what we can to help these folks,” Causey told The Smoky Mountain News on May 22. “I talked with the mayor a couple of weeks ago, and some folks from Canton are in the insurance business, and right now we’re trying to find office space just as soon as we can to make it happen.”

Causey added that workers with concerns could email him personally at Mike.Causey@ncdoi.gov.

“If anybody has a question, whether it’s health insurance or any other type of insurance, I’ll make sure somebody gets back with them to help them and guide them so they won’t be out on a limb,” he said.

Haywood’s House rep, Republican Mark Pless, said he was aware of the situation and that he’d be talking to Blue Cross Blue Shield in Raleigh this week, but he also wants to know what the state’s done in situations like this in the past.

Sen. Kevin Corbin (R-Franklin) doesn’t represent Canton anymore — a result of redistricting — but he does represent the rest of Haywood County and has worked closely with the town’s current senator, Mitchell County Republican Ralph Hise, on constituent concerns in Canton.

Corbin, an insurance professional by trade, also serves on the Senate’s Commerce and Insurance Committee. He says workers with concerns should talk to an insurance professional — not necessarily him — to ensure they understand their options.

He’s also taken his concerns to the General Assembly.

“I am working on a package right now for the budget for Haywood County, and one of the things would be for individual assistance — about $40 million in a relief package,” Corbin said.

Some of that money will come in the form of direct appropriations to Haywood County government and to Canton’s municipal government, in order to plug future budget holes that are anticipated to be in the range of $2 million a year for each local government unit.

If Corbin’s package makes it into the final budget, some of those unrestricted funds granted to the county and to Canton could be used for, well, just about anything.

“I don’t think we need to dictate from Raleigh what they spend that money on,” Corbin said.

They could take the form of some locally managed relief fund to help with other municipal needs or with workers’ income loss, mortgages, car payments, or even health care coverage premiums.

“I appreciate Sen. Corbin and others from both sides of the aisle putting forward proposals to help the citizens of Canton and Haywood County,” Smathers said. “Obviously waste water treatment is of major importance, and also filling the major budget gaps that exist due to the closure of the mill. Our goal is to maintain a level of service before and after the mill’s closing. After wastewater, I expect whatever’s left to go to filling a budget that has a tremendous hole in it.”

On May 15, North Carolina’s Senate released its proposed state budget, but it’s thought to be so far apart from what the House wants that negotiations between the two chambers will take time.

Although Canton could be in line for those direct appropriations related to the mill’s closure, they probably won’t come in before the bulk of Pactiv’s employees are given their walking papers.

All told, the situation with Pactiv underscores an eerily prescient point in the Pillowtex report.

Near the end of the 29-page document is a section titled “Lessons learned/opportunities going forward.”

The second point, penned nearly 20 years ago, still rings true today — at least in Canton.

“The HCTC represents a desirable policy goal of ensuring that dislocated workers have health insurance. The reality of the individually underwritten policies with risk-based tiered pricing resulted in a pricing structure that was unaffordable even with a 65% premium subsidy. What are the implications of unaffordable health insurance for the unemployed? Is there a fundamental flaw with employment-based health insurance coverage?”

Be prepared

Some employees at Pactiv Evergreen’s Canton and Waynesville facilities may soon experience changes to their health care coverage. To help affected workers, their families and their children, Blue Cross Blue Shield of North Carolina will host two full-day sessions where people can learn more about their situation and their options. A number of documents, including income tax information, may be required to sign up for coverage, so be sure to check milltownstrong.com for a complete list. Walk-ins may be accepted as space allows, but it’s probably best to schedule an appointment. For those who can’t make the appointments due to work schedules, a spouse or family member may attend in their stead. Gas cards are available for those who can’t afford to travel. Appointment slots are filling up quickly, so don’t delay, and don’t worry — Jan Plummer, Mountain Projects program coordinator, says Blue Cross Blue Shield will continue to host these events until people stop coming. For more information, contact Plummer at 828.492.4111.

Time: 9 a.m. to 6 p.m.

Dates: May 23-24

Location: Haywood Community College, Hemlock Building (first building on left), 185 Freedlander Drive, Clyde NC 28721

Contact the North Carolina Department of Insurance

North Carolina’s Insurance Commissioner Mike Causey wants to help workers affected by the impending shutdown of Pactiv Evergreen’s Canton and Waynesville facilities with unbiased health care coverage information. Those with questions are encouraged to call 919.807.6003 Monday through Friday from 8 a.m. to 5 p.m. to speak to an operator about their situation. Those who call outside those times can leave a voicemail and expect a call back. Causey also provided his personal email address, mike.causey@ncdoi.gov, for the same purpose.