Share this story

- The 2021 biennial budget included $100 million for teacher supplements, but some teachers are saying they aren't seeing any extra money in their paychecks. Here are some reasons why that may be the case.

- Teachers, are you wondering why you're not seeing extra money in your paycheck from state-funded teacher supplements? We have some possible explanations.

A reader asked EdNC about state-funded supplements for teachers. They said that a chart published by EdNC showed that teachers in their district would receive a certain supplement from the state, but their district payroll department said the actual number would be less.

Another reader representing a number of teachers said that they hadn’t received any extra money from the state supplement fund.

What’s going on?

The biennium budget passed by lawmakers in 2021 included $100 million for teacher supplements in most districts around the state. In the chart below, you can see how much money districts were estimated to get and how much that would amount to per state-funded teacher position. This chart came out around the time the budget passed.

However, just because Bladen County, for example, shows $2,603 in teacher supplement assistance per state-funded teacher position, that doesn’t mean that’s how much a teacher in Bladen County is getting. The numbers from the previous documents included early estimates.

The state Department of Public Instruction (DPI) sent this document to districts in February that explains how the money can be distributed. It has an updated chart created with more up-to-date calculations. It shows the real maximum amount of money a teacher could get.

You can see that, using the more up-to-date information, a Bladen County teacher could get a max of $2,150, rather than the $2,603 listed on the previous document.

But even so, teachers may not be getting the maximum.

Let’s see why.

The first thing to note from DPI’s guidance is that district school boards must decide how the money is to be distributed. The budget that included this funding passed in November 2021. It wasn’t certified until January, and districts didn’t receive the money until after that. School boards then had to decide on distribution.

If a teacher has not seen any increase in their paycheck from this program, it could be because their district school board hasn’t yet decided how or when to distribute the money.

The document says that no salary supplement for an individual teacher can exceed the “per-teacher funding amount awarded.” That means that — using Bladen County as an example again — no teacher in that district could get more than $2,150. But they could get less.

In addition, assistant principals or principals who are paid according to a teacher salary schedule are eligible for these supplements.

One line in the document makes clear that the state supplement can’t be used to “supplant non-State funds provided for salary supplements.” That means that districts can’t substitute state funds for district funds, give teachers the same amount of money they would have been given anyway, and then pocket the difference. They must give teachers what they would have already given them and then use the state funds to supplement that.

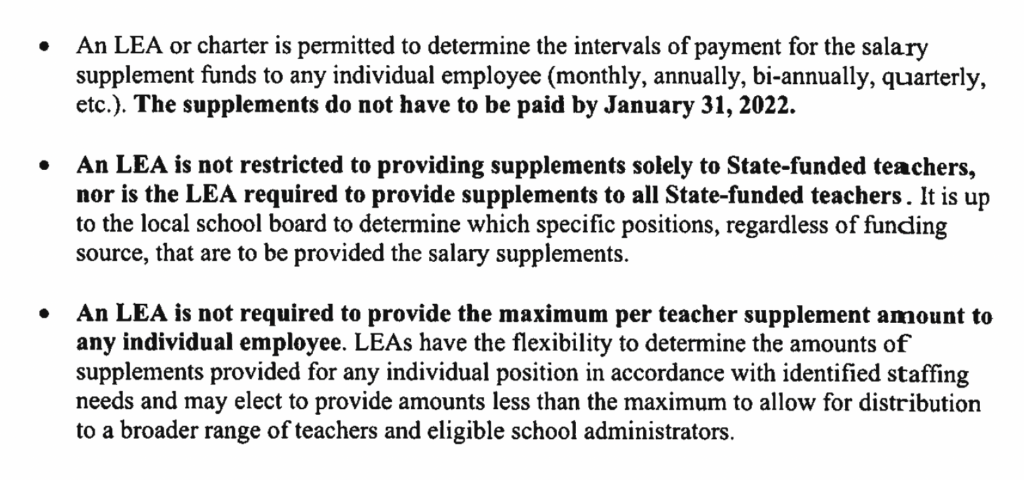

Here are three other key points from DPI’s supplemental funding document:

The first bullet point above highlights that it’s up to each district to decide when teachers get the supplemental funds. So, a teacher won’t necessarily see extra money in every paycheck. They might, but they also might get a quarterly pay out, a bi-annual payout, or even an annual payout — depending on what their district chooses. (In the case of an annual payout, that would mean teachers would receive the supplement in one lump sum.) As a general rule, however, districts must distribute the funds for this fiscal year before it ends on June 30, 2022.

According to the second bullet point, districts don’t just have to use the money on state-funded teachers. They could, for instance, divide up the money among all of their teachers — both those funded by the state and those funded by the district. In that case, teachers would get less from the state-funded supplements than the maximum.

This may appeal to some districts, because if they distribute the supplement solely to teachers funded by the state, that would mean district-funded teachers would be left out. (Alternatively, districts would have to come up with money on their own to raise district-funded teachers to the level of their peers.)

The second bullet point also makes clear that the district isn’t required to give the supplement to all of its state-funded teachers. It bears repeating: Districts have discretion on distribution.

The third bullet point says that districts don’t have to give the maximum per-teacher supplement amount to anybody. Districts can decide the amount they want to give, as long as it’s not more than the maximum.

And finally, these supplemental funds are considered salary, not a bonus. And they count towards retirement.

Correction: This article originally stated incorrectly that districts didn’t have to pay out supplements to teachers this year. Districts have to pay out the funds for this fiscal year before it ends on June 30, 2022.