|

|

Editor’s note: This story was updated on May 13 at 11 a.m. to include the state’s most revised revenue forecast.

The state’s Consensus Forecasting Group (CFG) updated its general fund revenue consensus on May 10, estimating a smaller surplus from its April projection. According to the May revised consensus, North Carolina has a projected one-time $987 million surplus in state revenues through Fiscal Year (FY) 2025.

This forecast is $430 million lower than the state’s April forecast.

“April, when income tax returns and payments for the prior tax year are due, is the most uncertain month for revenue collections,” the surplus document says. “The CFG issued the April 2024 consensus forecast before the Department of Revenue began processing the bulk of those payments, which required the CFG to project the amounts for those payments in the forecast.”

During the second week of the short session, the Senate passed a bill that would eliminate the waitlist for Opportunity Scholarships, allocating an additional $463 million to the program over the next two years. House Speaker Tim Moore, R-Cleveland, told media ahead of the session that he would like to see funding for child care subsidies, additional raises to school and state employees, and an additional $400 million toward Medicaid.

The proposed new funding for Opportunity Scholarship vouchers and Medicaid makes up roughly 90% of the state’s surplus.

“…Although the revision represents less than a 1% decrease to the General Fund revenue forecast, it will provide policymakers with more accurate information, enabling them to make informed budget decisions,” the document says.

North Carolina has a projected one-time $1.4 billion surplus in state revenues through Fiscal Year (FY) 2025, according to the latest consensus revenue forecast released on Wednesday by the Office of State Budget and Management (OBSM) and the General Assembly’s Fiscal Research Division.

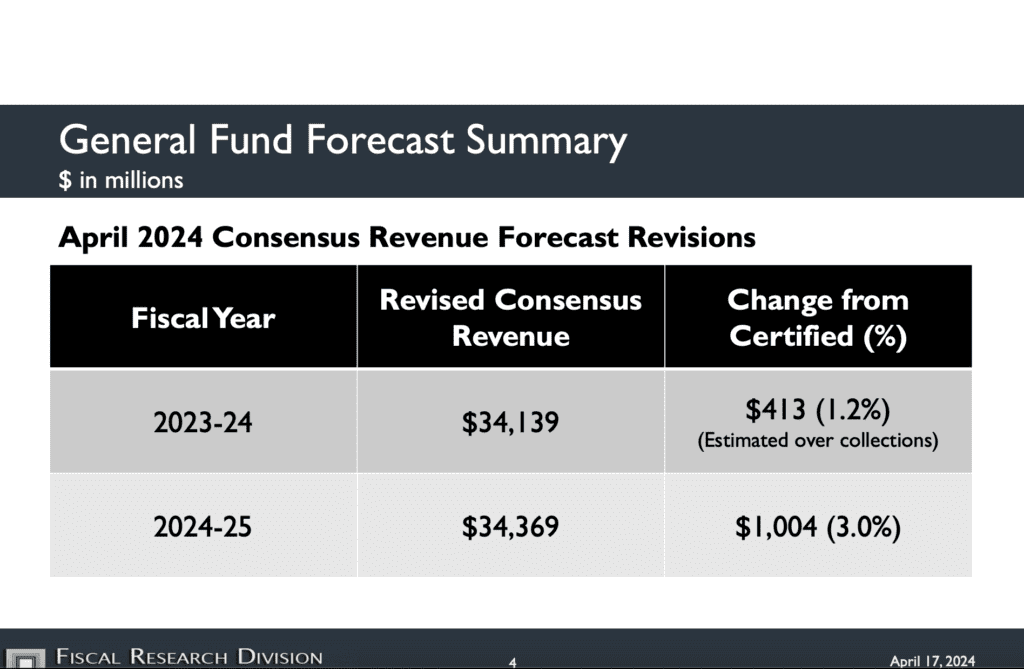

That surplus includes an estimated $413 million in the current fiscal year, and an estimated $1 billion in additional revenue in FY 2024-25.

With those extra anticipated funds, the revised revenue forecast for FY 2023 is $34.14 billion, a 1.2% increase from the certified budget. In FY 2024-25, the revised forecast is $34.37 billion — reflecting the expected $1 billion surplus, or 3% increase from the certified revenue.

The anticipated overcollections come from individual income and sales taxes, the OBSM document says, “due largely to continued growth in earnings and consumer spending.”

However, the forecast anticipates lower corporate tax revenues “due primarily to a larger-than-expected shift in business tax collections from corporate income tax to individual income tax.”

“The upward revision is due to more robust economic growth than foreseen at the time of the last consensus forecast in May 2023,” the OBSM consensus document says. “Contrary to the CFG’s (Consensus Forecasting Group) expectations in May 2023, the economy demonstrated greater resilience and avoided a predicted period of stagnant growth, or ‘slowcession,’ in late 2023 and 2024. Instead, the April 2024 consensus forecast expects a ‘soft landing,’ with inflation easing toward the Federal Reserve’s 2% target even as the economy continues to grow at a modestly slower pace than in 2023.”

Consensus forecasts are an essential component of the state’s budget process, as they help lawmakers know how much money is on the table to be invested.

The state’s legislative short session begins next week, on April 24. During this session, lawmakers can adjust the two-year budget passed during the previous long session and are able to discuss bills that previously passed one house or recommendations from a study commission.

Democratic Gov. Roy Cooper typically releases his budget proposal shortly after the consensus forecast comes out. Then, the House and Senate each release a proposal and work together to pass an updated compromise budget.

House Speaker Tim Moore, R-Cleveland, recently told media that he would like to fund more money for the Opportunity Scholarship program. The program, which funds private school vouchers at eligible schools, was expanded during the long session to all families regardless of income.

About 72,000 applications were received ahead of the deadline on March 1, and of that, the families of 13,511 students were notified that they received a scholarship for the 2024-25 school year.

Moore said Republicans are discussing funding an additional $300 million toward the program, the News & Observer reported. The 2023 budget set the revised appropriation for the Opportunity Scholarship grant fund reserve to $354.5 million in FY 2024-25.

The families notified so far that they would receive a scholarship were all Tier 1 families, meaning they came from the lowest income levels. This means additional funding would go toward families with higher incomes.

Moore also said he would like to see funding for child care subsidies, additional raises to school and state employees, and an additional $400 million toward Medicaid.

On Thursday, Moore released an email statement regarding the $1.4 billion surplus.

“Today’s revenue forecast is a sign that North Carolina is on the right track,” he said. “Our conservative approach to responsible spending has been effective in strengthening our economy and attracting business to our state. When those businesses bring thousands of jobs to NC and our economy is strong, all of North Carolina wins.”

The OBSM document used more uncertain language regarding the forecast.

The end of April is typically the most uncertain time for revenue collections, the document said. Another revised consensus will be released in mid-to-late May if actual collections differ significantly from the most recent forecast.

“Revenue forecasts are always uncertain,” the document says, “but a recent business tax change affecting pass-through entities has further raised forecast uncertainty for individual and corporate income taxes due to a shift in payments between tax types and to differences in taxpayer behavior between business entities and individuals.”

You can read the full OBSM forecast document here. You can also view the Fiscal Research Division’s forecast presentation here.